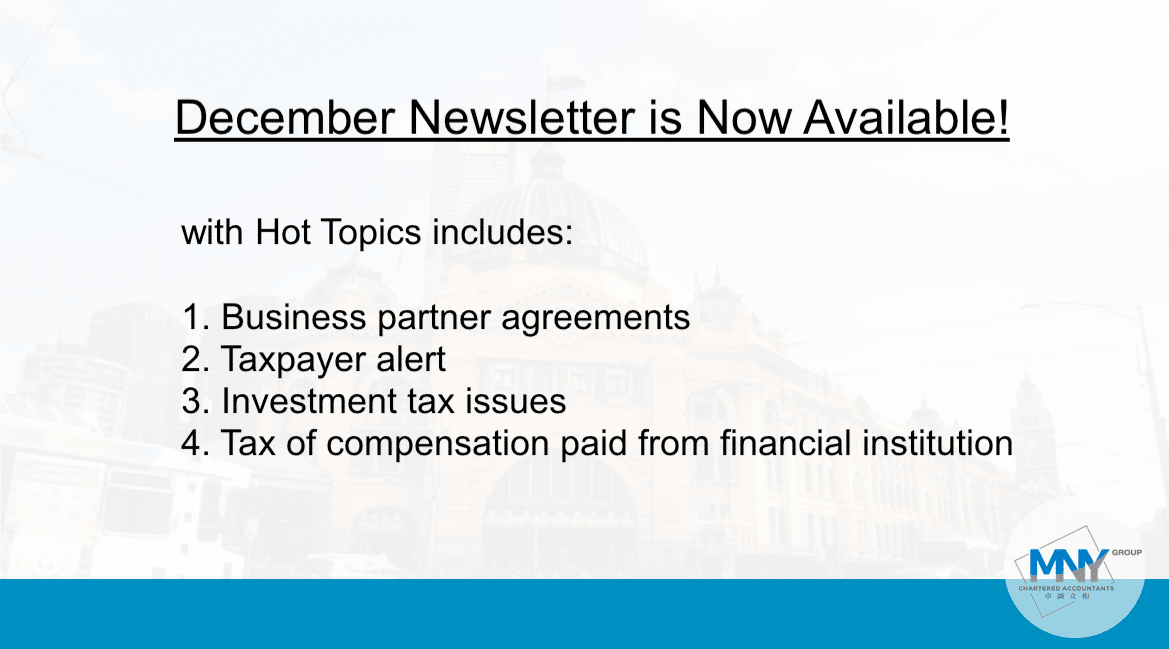

Accounting News

Becoming The Executor Of A Deceased Estate

There comes a time in many people’s lives when they are appointed the executor of a deceased estate.

How to determine if your software revenue is a royalty income.

Royalty income is income received from allowing someone to use your property. Receipts arising from the development and marketing of computer software might be treated as royalty income.

Avoid common mistakes in your business return, and include appropriate income

We know you want to get your tax right, so it may help you this tax time to know how to avoid making what the ATO has found are the most common tax mistakes.

The tax treatment of cryptocurrency

Cryptocurrencies, once again surging in popularity, have a unique tax treatment that every taxpayer dealing with cryptocurrency should be aware of.

Evidencing SMSF property valuations

The ATO recently clarified the evidence that is required to support real property valuations within SMSFs, particularly in light of the unique challenges brought about by COVID-19.

13 Steps To Apply ABN

It is relatively easy to apply ABN on your own, here are break down steps to apply an ABN from Australian Business Register

The SMSF Sector Has Been Growing By $62,400 Every Minute

Total superannuation industry assets were $2.9 trillion as at 30 June 2020. Of this total, $1.9 trillion was held by APRA-regulated superannuation entities and $0.7 trillion was held by self-managed superannuation funds (SMSFs), which are regulated by the ATO.

Taken Goods for Private Use? Here’s the Latest Values.

The ATO knows that many business owners naturally help themselves to their trading stock and use it for their own purposes. This common practice can occur in businesses such as butchers, bakers, corner stores, cafes and more.

Unexpected lump sum payment in arrears? There’s a tax offset for that!

A lump sum payment in arrears is a payment you may receive that relates to earlier income years. The general rule is that employment income is assessable in the income year it is received, regardless of the period the payment covers.

A Hand Up for Small Businesses on Cash Flow

The ATO has produced a “Cash Flow Coaching Kit”, which is a free resource and designed as a value-add advisory tool for small business owners.

Vehicle Benefit FBT Treatment Changes Under COVID-19

The special circumstances that coronavirus has thrown our way looks like having some very practical outcomes on certain areas of fringe benefits tax (FBT). One of the most prevalent and well-established category of fringe benefits centres on the provision and use of vehicles.

Update Your ABN … or Miss Out!

Government agencies regularly access data contained in the ABN registration, and where this is not up-to-date the taxpayer may be missing out on stimulus measures, grants, and other government support.

Natural Disasters and Help with Your Tax

The ATO says that if you are affected by natural disaster, such as bushfires, floods or storms, there is generally no need to worry about your tax affairs right away.

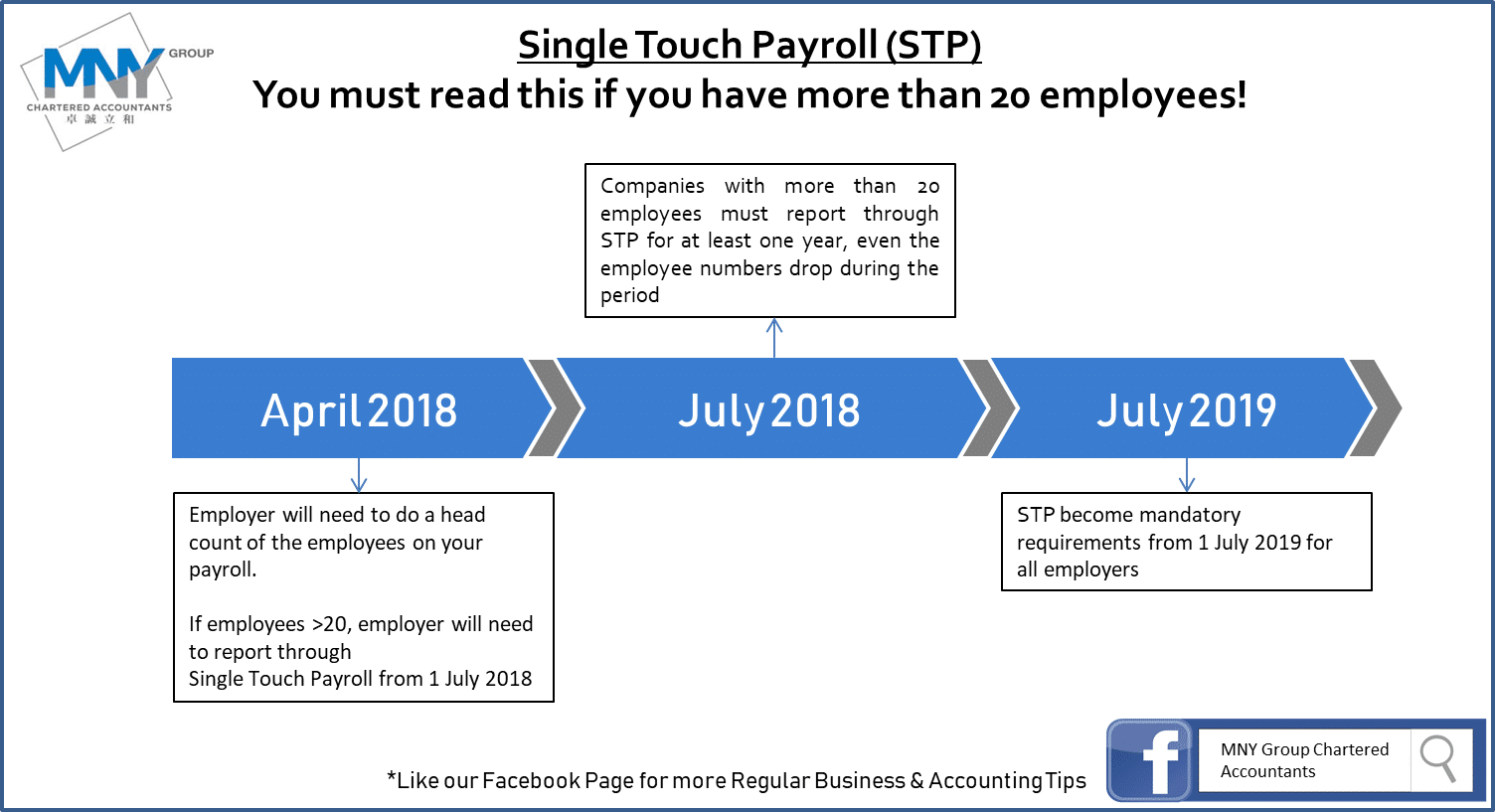

SINGLE TOUCH PAYROLL When Your Reporting Can Cease

A business may no longer be required to lodge single touch payroll (STP) reports for a number of reasons.

Getting A Tax Valuation From The ATO

Not every individual situation fits neatly with the tax laws as they stand — sometimes a taxable item’s known value may need to be determined.

JobMaker Hiring Credit: What You Need to Know

The JobMaker Hiring Credit scheme was passed into law in mid-November 2020. JobMaker was part of the 2020-21 Federal Budget, and will operate until 6 October 2021.

What Is a Recipient Created Tax Invoice?

Tax invoices are an essential element of Australia’s taxation system, and serve both to collect taxation revenue related to the goods and services on which GST is levied as well as record the credits that are claimable by eligible businesses.

Claiming Interest Expenses for Rental Properties

Interest is a common deduction claimed by taxpayers. Generally, interest is seen as being inherently deductible where it is incurred in gaining or producing assessable income. However, interest expenses will not be deductible where money is used for a purpose that does not produce income, even if the money is borrowed by being secured over rent-producing property.

Small Business CGT Concessions: Goal Posts Moved on Vacant Land and Active Assets

Businesses wanting to claim CGT concessions for active assets may find hope in a recent Full Federal Court decision on a long-contested vacant land case.

Calling Time Out on Your Business? Some Essentials You’ll Need to Know

Calling time out on your business, you will need to know:

1. lodgement and payment

2. refunds

3. cancel PAYG withholding registrations

4. cancel the ABN

5. record keeping

A Run-Down of the New Loss Carry Back Measure

The last Federal Budget carried with it a number of tax changes (such as loss carry back rules) that were designed to assist the Australian economy recover from the impact of the COVID-19 pandemic.

ATO Takes Aim at ‘You-Scratch-My-Back’ Auditing Arrangements

The ATO has indicated that approved SMSF auditors who continue to engage in reciprocal auditing arrangements will be subject to increased scrutiny.

JobKeeper Extension’s Alternative Turnover Tests

The extension of the JobKeeper scheme is now based on current GST turnover, not projected turnover.

Rounding Of GST Where Fractions Of A Cent Result

The ATO has devised special rounding conventions where an amount of GST includes a fraction of a cent.

The Investment Option That Can Hide Unexpected GST

ATO is concerned that not every investor in residential property is fully aware that it is an option that may bring with it unexpected GST obligations.

Both Tax and SMSF Audits on Still on ATO’s Radar, But Some Leniency Given

While the ATO has lately been focusing on the rollout of stimulus measures, it has also flagged that audit work is not off the table completely.

ATO’s Cyber Safety Checklist

In a new update the ATO reports that it is receiving reports of email scams about JobKeeper and backing business investment claims.

What the “Full Expensing” Write-Off Deduction Means for Business

The Federal Budget measure of allowing businesses to fully write-off eligible assets is a boon to Australian businesses, even though the measure is temporary.

Federal Budget 2020-21

Federal Budget 2020-21

1. BUSINESS

2. R&D TAX INCENTIVE

3. TEMPORARY LOSS CARRY-BACK

4. SUPERANNUATION

5. HOUSING

6. EMPLOYMENT AND TRAINING

7. MANUFACTURING

8. ENVIRONMENT

9. HEALTH AND FAMILIES

2020-21 Lodgment Rates and Thresholds

This guide includes tax rates, including individual minor and non-resident rates, corporate rates, offset limits and benchmarks, rebate levels, allowances, essential super, FBT rates and thresholds.

Fears of Div 7A Danger From COVID-relaxed Loan Repayments Unfounded

The ATO has clarified its position regarding loans, and the repayments of loans that may have been put on hold for the period that COVID-19 has a grip on the economy and our lives.

New Data Matching Programs Initiated By The Federal Government

Over the first quarter of this financial year, the government has initiated two new data matching programs, using data that the ATO holds.

JobKeeper Rules, Conditions and Payment Rates Have Changed

Legislation has been put in place to extend the JobKeeper scheme beyond its original sunset date, although the rates of payment and certain other details have been altered

Electronic Execution of Documents During COVID-19

The COVID-19 pandemic has prompted state and territory governments to temporarily ease the manner in which documents are executed.

COVID-19 Issues for Companies and Trusts

With many having received cash flow boost and JobKeeper payments, there can arise some unique issues where these amounts are received within a trust or company.

Claiming A Deduction For Transport Expenses When Carrying Bulky Equipment

As a general rule, expenses relating to travel between home and work (and vice versa) are non-deductible.

Rental Property: Tax Approach Adjusts for COVID-19

Rental Property: The COVID-19 pandemic has placed property owners, and tenants in many cases, in unfamiliar territory.

The JobKeeper Scheme Gets An Update, Plus An Extension

The JobKeeper payment, which was originally due to end after 27 September, will now continue to be available to eligible businesses (including the self-employed) until 28 March 2021. However there are some changes to consider.